Learn from the Leaders: Efficiency is Key to Growth

In such troubling and uncertain economic times, many credit unions are just trying to survive. To do so, they must be agile and adapt to changes in member behavior. It’s also vital they communicate and reach out to members to understand their needs and wants during this crisis. Credit unions are discovering now more than ever that the technologies and core processing system they use make a huge difference in terms of growth.

In such troubling and uncertain economic times, many credit unions are just trying to survive. To do so, they must be agile and adapt to changes in member behavior. It’s also vital they communicate and reach out to members to understand their needs and wants during this crisis. Credit unions are discovering now more than ever that the technologies and core processing system they use make a huge difference in terms of growth.

One credit union that’s managed not just to survive but to blaze new pathways through this rocky climate is Freedom Northwest Credit Union of Kamiah, Idaho. Under the leadership of Scott Garrett, Freedom Northwest Credit Union has made, and continues to make, its mark in the credit union world through steady growth and efficient management over the last decade. Let’s take a closer look at some of the things this credit union has done to be successful.

The success of Freedom Northwest Credit Union

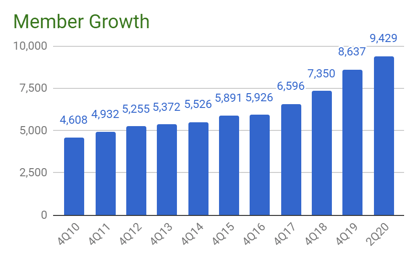

Founded in 1963, by a group of passionate volunteers in Kamiah, ID, Freedom Northwest Credit Union has always been dedicated to its members and led by the will and vision of its committed volunteers. This member-first attitude has built a strong backbone for the credit union and supported its growth since the beginning. Currently, the CU has over $268 million in total assets with more than 9,800 members.

Some of the key components to the success of the Freedom Northwest Credit Union include:

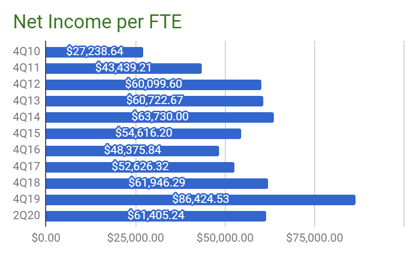

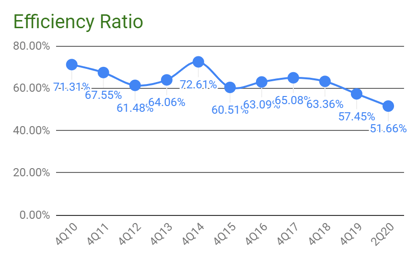

- Growth through efficiency. In 2010, the credit union had $40 million in total assets. To increase growth, CEO, Scott Garrett chose the FLEX core processing system to help identify where the CU could be more efficient. “The core system touches so many areas of the credit union that getting that part right leads the way for other technology adoptions” shares Garrett. After implementing FLEX, many key growth indicators changed for the better. For example, prior to running the FLEX core, employees were generating $27,238 in net income per employee. In Q2 of 2020, staff generated over $60,000 per employee.

- Expanded services. With increased growth, Garrett has been able to open more physical locations to reach more members. Also, having such consistent growth allows the CU to offer members increased services like better returns on deposits, competitive loans, free online banking, and relationship pricing for members.

- Member-focused mentality. From the beginning, Freedom Northwest has always maintained their member-focused mentality. “We have been able to expand our market to have even more potential members, which gives us more confidence in our future. People who were traditionally outside of our market will be able to have a full consumer relationship with us; we just don’t think that’s going to require a teller line,” shares Garrett. Driving growth and efficiency is beneficial not just to the CU’s bottom line, but to the members and their financial security. That’s why since 2010, member capital has also increased at an average annual rate of 17.5%.

Its clear Freedom Northwest Credit Union is making a mark through impressive efficiency and leadership from Garrett and his management team. They collectively understand the value and importance of partnering with a core solution that can deliver the technologies their credit union needs in order to support and deliver more efficient operations within an institution. “With the simplicity and efficiency of FLEX, we can maximize our focus on our business and members,” said Garrett.

Efficiency is Key to Growth

What most credit unions don't realize is that core system efficiency is at the heart of their operational direction and success. Your core system should aid in the magnification of your operational efficiencies and help expose your inefficiencies. By applying metrics such as net income per full-time employee, member growth and efficiency growth to your credit union operations, you can gain valuable insights into how efficiently you are using the assets you have as well as where you are suffering from imbalances.

Download our eGuide to learn more about the key ratios for credit unions to know.

Bonus: Check out the feature article from the 2021 Callahan Supplier Market Share Guide to learn how future proofing your core with will grow your credit union.

.jpg)