How Core System Technology Can Affect Your Credit Union Metrics

Since the pandemic struck in March, credit unions have had to adjust to the times and reevaluate how they do business. While maintaining healthy relationships with members continues to be crucial, there are other factors that can also determine a CU’s success. One of the most vital factors for credit unions today is choosing the right technology to communicate with members, generate loans, and increase the overall efficiency and functioning of your CU.

Since the pandemic struck in March, credit unions have had to adjust to the times and reevaluate how they do business. While maintaining healthy relationships with members continues to be crucial, there are other factors that can also determine a CU’s success. One of the most vital factors for credit unions today is choosing the right technology to communicate with members, generate loans, and increase the overall efficiency and functioning of your CU.

The success of your credit union is directly connected to what technologies are used. That’s why choosing the right core system solution is so important to maintaining growth and sustainability. However, it’s not always easy to know which core system technology is right for you. Before deciding on a core system or before making a change, take the time to evaluate certain metrics that serve as key performance indicators for your CU.

Understanding the key performance indicators for your CU

Now is the perfect time to evaluate your credit union’s metrics to determine where you are having success and where you are failing. Understanding credit union key performance indicators and metrics allows CU executives to track internal goals, identify opportunities, reinforce strengths and reveal weaknesses.

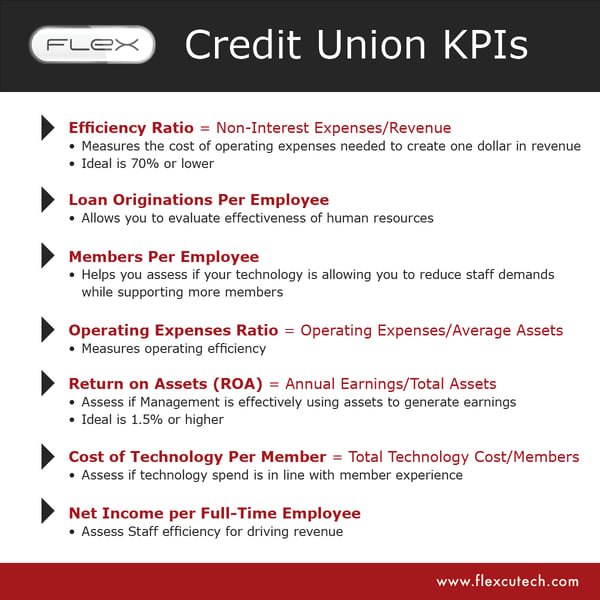

Here are some vital metrics that should matter to credit unions:

- Efficiency Ratio. This is one of the most important metrics to determine if your core system technology is working effectively. The efficiency ratio measures the cost of operating expenses needed to create one dollar in revenue. If your efficiency ratio is 80% that means it takes $.80 to create $1.00 of income. The right technology should help your CU reach an efficiency ratio of 70% or lower.

- Loan Originations per Employee. The average CU originates about 1 million dollars in loans per employee. Determining the loan originations per employee at your CU can help you evaluate the effectiveness of your human resources. An efficient core system software can help your CU generate more loans without increasing the number of staff on your team.

- Operating Expenses over Average Assets. This metric compares your CU’s expenses to assets in order to evaluate the operating efficiency and operating strategy of your CU. As each credit union is unique, it’s important CU’s pursue their strategies based on their size and goals. Understanding this metric can help executives evaluate the CU’s overall performance and readjust their strategy accordingly.

- Members per Employee – This is a relatively straightforward comparison of the number of members to the number of full-time employees. If your technology is doing its job, you need less staff to support more members. If you find you are hiring more staff in addition to expanding your technology arsenal without seeing membership growth, then something is amiss. 383 members per employee is the credit union average... the right technology can help you double this number without compromising the quality of member service.

- Return on Assets (ROA). This metric is reached by dividing a CU’s annual earnings by its total assets. Analyzing the CU’s ROA can help executives determine if management is efficiently using their assets to generate earnings. A ROA of 1.5% or higher is ideal.

- Cost of Technology per Member. Technology is intended to improve member experience; however, sometimes the cost of technology is too high. This metric is determined by taking the total cost of your CU’s technology and dividing it by your member base to see what the cost of technology is per member. Understanding this metric can help your CU make better decisions about what technologies to use and how to use them.

- Net Income per Full-time Employee. This metric can help you evaluate things like member-staff relationships, and how efficient your staff is at driving revenue for your credit union.

The right technologies and credit union core systems should help your CU not only evaluate these key metrics, but also be able to make adjustments in order to improve efficiency, growth and member relationships for your CU.