Convenience is the Key to Mobile Banking Adoption

No matter what your major was in college, you no doubt had to learn the "Technology Adoption Lifecycle." Perhaps it was taught in the context of history and the industrial revolution's impact on agriculture. Or, more likely, you remember it within the teaching of your economics or business programs as a way to characterize companies' cultures when it comes to embracing technological advancement, and the resulting adoption of that technology by the market.

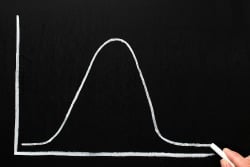

Technology adoption lifecycle model (courtesy of Wikipedia):

The technology adoption lifecycle model describes the adoption or acceptance of a new product or innovation, according to the demographic and psychological characteristics of defined adopter groups. The process of adoption over time is typically illustrated as a "bell curve." The model indicates that the first group of people to use a new product are called "innovators," followed by "early adopters." Next come the early and late majority, and the last group to eventually adopt a product are called "laggards."

Internet banking for credit unions is a must have, and credit unions who are just now considering a product would be considered in the late majority phase. This is also the phase where it is imperative for CU's who have already adopted the technology to enhance their existing digital capabilities and end user experience in order to stand out among the competition as the market becomes saturated. Because while CU's are on their own bell curve in offering the new technology, consumers are on a separate, yet related curve in adopting it for their own use.

Emphasizing ease of use and convenience becomes key

According to a report by PwC, by the end of 2015, customers will mainly interact with their bank network through digital banking. The report, ‘The new digital tipping point’ reveals more consumers are using online and mobile channels to access financial products:

- PwC conducted research with over 3,000 banking customers across nine developed and emerging markets. Findings showed consumers across the different regions surveyed are demanding innovative digital capabilities to access financial products and are willing to pay for services they believe will offer more convenience and value.

- A majority (69%) of consumers surveyed said they currently use the internet to purchase financial products. While only 33% of respondents currently use mobile to purchase financial products... It is not surprising that 67% of Generation Y respondents (those born in the l980s and l990s) currently use, or are considering using, mobile channels for banking.

- To remain relevant in the market... (credit unions and banks) need to look at innovative ways to use digital technology to create value for customers, especially for banks that want to expand outside of their traditional markets.

Expanding the offering of your internet and mobile banking products becomes more important. The more options a consumer has when interacting with your mobile product, and the easier it is to use, the greater the chance you have for adoption. A fully integrated internet/mobile banking product set, where an end user is NOT redirected to multiple sites, and NOT required to input multiple logins to accomplish varied tasks, becomes the credit unions ticket to member adoption.

Offering a larger range of products available through your digital channels, such as built-in remote deposit capture, is another enhancement that will further drive adoption, and help your credit union gain new members. Perhaps it is time to re-evaluate your internet/mobile banking product or your strategy to deliver and enhance your digital environment?