Is Paid Social Media Too Expensive? A Guide to Organic Growth

So you may have heard: Facebook got into a bit of trouble this year. To be exact, the scandal that unfolded on national news outlets and ultimately broadcast from the Senate and House floors started well before 2018. What Facebook, Cambridge Analytica, and the Russians did to the social media landscape has a far-reaching impact on all platforms, affecting both businesses and credit unions. Facebook, Instagram (owned by Facebook), Twitter, LinkedIn, etc. have all changed their algorithms and/or policies in response to this privacy breach and resulting abuse of data, which was witnessed on a global political scale. These changes have made it more difficult for your credit union to get your message in front of your members and potential members. So how do credit unions adapt to these changes and shift their social media strategy, especially those with small paid advertising budgets, to compete in this new landscape?

So you may have heard: Facebook got into a bit of trouble this year. To be exact, the scandal that unfolded on national news outlets and ultimately broadcast from the Senate and House floors started well before 2018. What Facebook, Cambridge Analytica, and the Russians did to the social media landscape has a far-reaching impact on all platforms, affecting both businesses and credit unions. Facebook, Instagram (owned by Facebook), Twitter, LinkedIn, etc. have all changed their algorithms and/or policies in response to this privacy breach and resulting abuse of data, which was witnessed on a global political scale. These changes have made it more difficult for your credit union to get your message in front of your members and potential members. So how do credit unions adapt to these changes and shift their social media strategy, especially those with small paid advertising budgets, to compete in this new landscape?

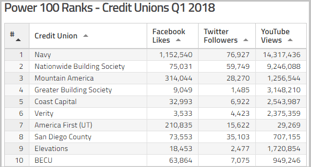

For starters, let's analyze how you measure social media success. On one hand, counting followers makes us feel good about our presence, but does little to tell us how well our social media is performing? It's an easy metric, though, to compare across channels and competitors. With this one metric, you can quickly see how many followers your competitors have versus how many you have. The Financial Brand recently released The Power 100 Credit Unions on Social Media report. The rankings were based in part on the number of followers each CU had on Facebook and Twitter. What do these top 100 have in common? Deep pockets. Their marketing budget not only allows them to pour money into paid advertising bid prices, but they also have extensive marketing departments, graphic designers, strategists and researchers that don't come cheap.

It's no shock who is at the top of the list. Navy Federal Credit Union is the giant in the industry, and the same goes for their social media reach. So much so that

It's no shock who is at the top of the list. Navy Federal Credit Union is the giant in the industry, and the same goes for their social media reach. So much so that

Facebook actually developed their own case study around NFCU's success when it comes to using their paid advertising opportunities. Their success has been well documented in the past six years. In January 2012, NFCU increased their Facebook likes from 22,000 to a staggering 770,000 in one year, which bumped them up to 12th place for best performing company across all industries globally on social media that year. They currently boast over 1.1M followers, making them... Just. Huge.

Most credit unions are not trying to go head to head with NFCU, and the majority of credit unions don't have the budgets that the Power 100 have for social media. Which brings us to the other measurement of success on social media... Engagement. Social Media Engagement means everything from a like to a click to a comment on a video view, etc. Harder to measure but more meaningful. More importantly, it can be accomplished without paid advertising. Publish content that is engaging, present it in the proper context, and format so people who matter will engage with you.

But herein lies the problem of the new algorithms and policies on social media. No matter how compelling your content, if your followers aren't seeing it, they can't engage. In an effort to appear more socially conscious, Facebook and others have put policies into place that ensure people see the feeds from family and friends first and then focus on posts from people that the individual has engaged with in the past. In other words, if you liked and commented many times on posts from a friend, you see their posts close to the top of your feed. But if it's a friend from high school you haven't replied or commented on lately, well, they get moved to the bottom of the line. Then and only then do people see business posts, even if they follow and like that business. As a result, the posts from your credit union are not getting the attention they may deserve.

Not all hope is lost. There are steps you can take to organically grow your following, and ensure your followers are engaging in your content to see an uptick in your social media analytics:

- Understand some of the new policies that impact your social presence. Not all platforms publish their algorithms that explain how they send out feeds, but Instagram and Facebook have released enough information that marketing firms have been able to piece together data. For instance, on Instagram and Facebook, only 10% of your followers will be shown your post when it is released, which is based upon those people who have responded more frequently to your posts in the past. If in the first hour of posting you received 3-5 comments from the 10% of your followers to whom it's shown, IG and FB will then push it to more of your followers. Knowing this, encourage your employees and friends who follow you to comment and engage whenever they can.

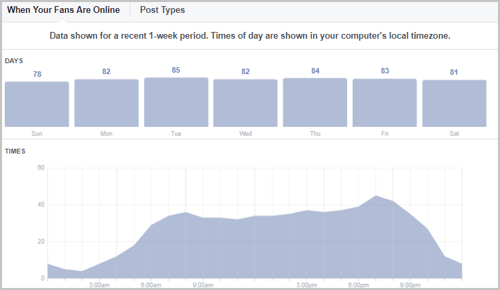

- Timing is everything. Given the above policy, make it a habit to push posts out at times that you know your most engaged followers are online and active on social media. In other words, if you block your employees from social media sites while at work, then don't push out your social posts during your open hours (or consider allowing them access during those times so they can engage with your sites).

- Never edit a post. Instagram particularly has come out and stated that edited posts after published will not be pushed out the same. If you made a big mistake, it is better to delete the post and wait a bit to re-post it correctly.

- Hashtags: Use them, but use them wisely. People with an interest in what you have to offer, especially people who write about financial information and credit unions, as well as other influencers in your community, will follow social media hashtags. If you use hashtags wisely, influencers will see your posts and are more apt to follow you and share your content. But remember to use no more than 5 hashtags per post and do not re-use the same hashtags in back-to-back posts to avoid getting marked as spam.

- Respond to comments and messages often. This impacts your score so you will be seen as a more engaged user. Facebook even displays your score for how responsive you are.

- Video. Use it. Bottom line. By 2019, video content will be the driving factor behind 85% of search traffic in the US. You don't need to spend a lot of money on video. It is more engaging than just words and can be accomplished with short gifs, Facebook live sessions, and other low cost or free methods of creation.

- Consider boosts. Boosting posts does not have to be expensive. If you have a promotion or a new bit of content that highlights your member services in an engaging way, consider small boosts. Create and save ad audiences based on your member profile, set a small budget for monthly boosts (you can start at just $5!) and measure the success you have in growth.

Social media has proven to be an incredible marketing tool, especially when marketing to new members. While the social landscape is changing, you do not need to have massive budgets to compete. Design a strategy to organically grow followers using the tips outlined above. It can really pay off!