P2P and A2A are GR8 for FIs!

In July of 2019, a report was released that found over 1 million internal transfers occurred in that month alone in US Financial Institutions, making up 67% of all money movement that month. The surge in P2P (Person-to-Person) payments continued, while A2A (Account-to-Account) payments between accounts at different financial institutions also rose, witnessing 2.35% of active digital users digitally transferring funds between accounts at various banks/credit unions. Not surprisingly, the overwhelming majority (77%) of those transfers came from smartphones. For Credit Unions, this is another strong indicator that mobile app development and enhancements are becoming a must have for members.

In July of 2019, a report was released that found over 1 million internal transfers occurred in that month alone in US Financial Institutions, making up 67% of all money movement that month. The surge in P2P (Person-to-Person) payments continued, while A2A (Account-to-Account) payments between accounts at different financial institutions also rose, witnessing 2.35% of active digital users digitally transferring funds between accounts at various banks/credit unions. Not surprisingly, the overwhelming majority (77%) of those transfers came from smartphones. For Credit Unions, this is another strong indicator that mobile app development and enhancements are becoming a must have for members.

The ability to split the restaurant check with a friend, submit your monthly rent or reimburse for something easily without cash is becoming more of a necessity. P2P payments allow you to send someone money easily from your bank account using your mobile phone. Venmo is quickly gaining momentum as a payments app, but as a result, they will become a larger target for cybercrime and don't offer the same protections and education your credit union can provide. Many members are leery of using third party apps like this, especially when they require a connection to their bank account. By developing your own mobile app and incorporating third party vendors to allow for both P2P and A2A transactions easily, you are further securing member loyalty. Having your own mobile app also allows you cross sell-opportunities because P2P payment users can stay in your mobile app instead of going elsewhere for similar capabilities.

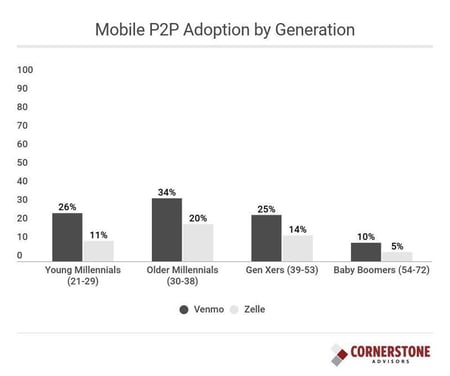

While the leader in P2P payments still has Zelle at the forefront, the overwhelming Zelle volume belongs to two big players - Chase and Bank of America customers. The non-bank providers (namely, Venmo, Square and PayPal) are showing tremendous gains. While Zelle is poised to cannibalize the bank volume, Venmo adoption outgains Zelle adoption rates across all generations. Take a look at this chart from a Forbes article earlier in 2019:

But it's not one or the other... both can be winners in this payments app war. Of Millennials and Gen Xers who make mobile P2P payments (and most of them do), half use three or more P2P and A2A services! And among smartphone-toting Baby Boomers, two-thirds use more than one service.

-1.jpg?width=728&name=Untitled-Project%20(14)-1.jpg)

P2P is about creating a better way for people to pay other people, and at its very core, needs to be easy while at the same time being trustworthy, secure, and instant. So if your credit union is considering enhancing your mobile app in 2020 and have yet to introduce a P2P option, now is the time to do it!