Mobile Banking App Improvements: The Next Frontier in 2024

In today's financial landscape, having a mobile banking app is no longer a mere advantage—it is an essential component of any credit union's offerings. However, the conversation has shifted from the necessity of an app to how credit unions can elevate their mobile banking experience. The key question now is: how can your credit union's app stand out in a crowded marketplace?

In 2024, members expect more than just balance checks and simple transactions. The competition is no longer about whether you have an app—it's about what your app can do for your members' financial wellness and convenience.

Advanced Features to Enhance Your Mobile Banking Experience:

- AI-driven financial insights – Offer personalized budgeting tips and spending patterns to help members manage their finances better.

- Mobile lending – Allow members to apply for and manage loans directly through the app, streamlining the process.

- AI-powered chat bots – Utilize a chatbot to respond to members' inquiries instantly, offering round-the-clock customer service that ensures your members feel supported at all times.

- Instant payments – No more waiting. Let your members move money around and have access to funds instantly. Eliminate delays. Empower your members to transfer funds and access their money immediately.

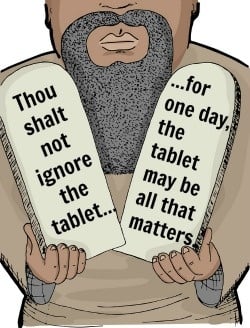

Your app isn't just a tool—it's an extension of your credit union, and a well-designed app is key to retaining members and attracting new ones. Innovative, highly-functional mobile features help differentiate your credit union from others in a crowded market. The goal now is to create a digital experience that members can’t live without.