Vendor Consolidation: A Core Technology Success Story

One of the biggest factors that can affect a credit union’s bottom line is how they use their core system technologies. An efficient core data processing system can help expand member services and attract new members while keeping the underlying costs of running the CU low. Credit unions that use a large number of vendors and third-party technologies often pay too much for technology and have less user-friendly platforms.

One of the biggest factors that can affect a credit union’s bottom line is how they use their core system technologies. An efficient core data processing system can help expand member services and attract new members while keeping the underlying costs of running the CU low. Credit unions that use a large number of vendors and third-party technologies often pay too much for technology and have less user-friendly platforms.

As the world becomes more and more digital, having the right core data processing system can be fundamental to a CU’s survival. Looking at the success of other credit unions is one way to learn more about quality core software solutions and what they can do for your institution. One credit union that has been able to increase efficiency and cut out third-party vendors by switching core systems is Connect Credit Union of Southern Florida.

Efficiency is Key: Connect Credit Union

A combination of strong management and smart decisions has made Connect Credit Union ($89 million) of South Florida a recent success story in the credit union world. And, as highlighted in a feature article in the 2021 Callahan Supplier Market Share Guide, their success has had much to do with discovering the right core data processing solution.

According to President and CEO Scott Meyer, before switching core systems, Connect Credit Union was using 23 separate vendors to service their needs. This was inefficient and expensive. Having multiple vendor contracts also made changing core systems challenging, since renewal dates did not always line up. But Meyer was determined.

“Our goal was to find better solutions for our members and consolidate systems to remove compatibility and integration issues,” Meyer said. And “as a result we chose FLEX. Those 23 vendor contracts touched our core system in one way or another." After converting to the FLEX system in 2019, the CU reduced their third-party vendors to just three.

Here are a few key outcomes that were a result of Connect Credit Union's core data software conversion:

- From 23 to 3. Because FLEX develops software, the need for most third-party vendors is eliminated. Connect Credit Union’s conversion to FLEX enabled them to enhance mobile banking services, remote check deposit, online banking, card controls, signature capture and general ledgers, and none of these improvements required third-party vendors. They are all driven by the FLEX core processing system. Vice President of Operations, Cynthia Ryan was so excited she even named her final CUNA Management School project “23 to 3,” saying “I thought 23 to 3 was an appropriate name and a fun title to play off of the 23 and me DNA testing kit.”

- Improved metrics. Connect Credit Union also saw an improvement in major key growth metrics such as operating expenses over average assets. Between 4Q 2018 and 2Q of 2020, their operating expenses over average assets metric improved from 4.09% to 3.48%. “For our employees, the core system conversion created efficiencies in our organization which allowed all of us to focus on helping our members financially,” Meyer said.

- Increased efficiency. By reducing the number of vendors, Connect Credit Union is saving time and achieving cost savings. They are better able to efficiently serve their members through a multitude of natively built products and features, including online and mobile banking. Additionally, regulatory burdens have been reduced as they now negotiate fewer contracts, and are required to conduct less due diligence on vendors.

Connect Credit Union isn’t the only CU that has benefited from switching their core system technology. CU’s of varying sizes all over the country have seen improvements from using more efficient core system technologies.

Vendor Consolidation May Be a Winning Strategy

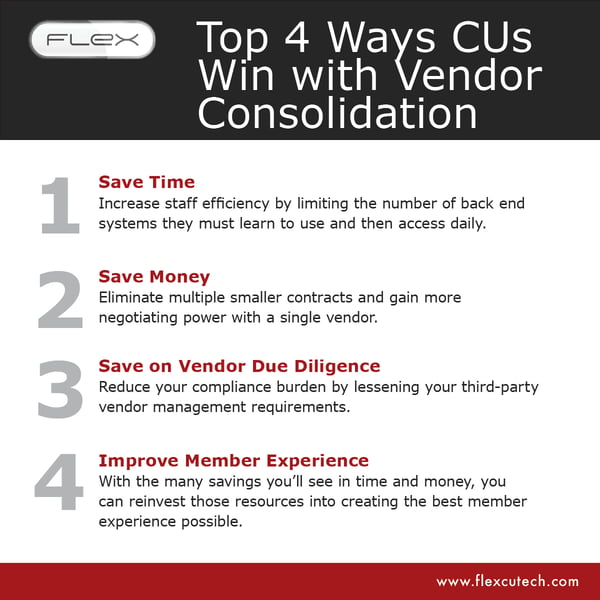

Here are some of the benefits your credit union may gain from consolidating vendors:

The fundamental success of any credit union depends on leadership, core values, strength as a company and commitment to members. But the right core data processing system can enhance every component of your existing structure in a variety of ways. As technology becomes more important to CU’s and their members, there’s no use denying the benefits of the right core system technology.

Download our feature article from the 2021 Callahan Supplier Market Share Guide to learn more about how future proofing your core with FLEX will grow your credit union.