The New Age of Mortgage Lending for Credit Unions

There have been many changes in the financial industry over the past couple of years, and credit unions have had to be agile and adapt to the latest trends. Although the sudden digital transformation of banking was difficult for many credit unions who pride themselves on personal service and community involvement, most were able to adjust and find ways to bridge the gap between digital banking and superb member service.

There have been many changes in the financial industry over the past couple of years, and credit unions have had to be agile and adapt to the latest trends. Although the sudden digital transformation of banking was difficult for many credit unions who pride themselves on personal service and community involvement, most were able to adjust and find ways to bridge the gap between digital banking and superb member service.

As the economy begins to rebound, one of the most important things for credit unions looking forward is mortgage lending. Mortgage lending has always been important to the health and growth of credit unions, and perhaps now more than ever. Recent data shows low interest rates have led to rises in mortgage lending, and credit unions are commanding a greater share of the market than in previous years. But they are also having to adjust to the new elements of digital lending, and for many credit unions, there is still a lot they could do to improve their digital banking platforms.

Recent mortgage lending statistics for credit unions look positive

There are many factors contributing to the changes taking place in the mortgage lending market. One is that as the economy reopens (over 900,000 jobs were added to the economy between June and July 2021), and unemployment rates continue to drop (currently 5.4% in July 2021), people are able to take out loans and make payments on time. And since the Federal Reserve cut interest rates to stimulate the economy in response to the pandemic, credit unions can borrow cheaper and offer lower rates to their members.

Listed below are a few recent stats from the Credit Union and Economic Reports:

- Loan balances. Loan balances are up 1% from June 2020, at the peak of the economic crisis, signaling that credit union growth is on the rise again. The only categories that reported negative loan growth over the past year was new auto loans (-1.1%) and business loans (-2.4%), and that’s good news for credit unions. This trend of loan growth is expected to continue as the economy comes back and infrastructure spending starts to kick in.

- Assets. Credit unions have seen a 22% rise in assets from a year ago, up to $381.2 million dollars. This is partly due to the consolidation of credit unions through purchases, mergers and liquidations. Unfortunately, some smaller credit unions have failed over the past few years and there’s a trend towards larger, more efficient CUs with larger asset bases.

- Loan delinquency. People defaulting on loans is at its lowest level in twenty-five years (.44%). Due to lower interest rates, stimulus checks and for some people, unemployment benefits, more people were able to stay current with their mortgage payments.

- First year mortgages. Credit unions increased their share of holdings of first mortgages from 4.5% of the mortgage market to 4.8% between June of 2020 and June 2021. They hold a total of $548 billion in first mortgages.

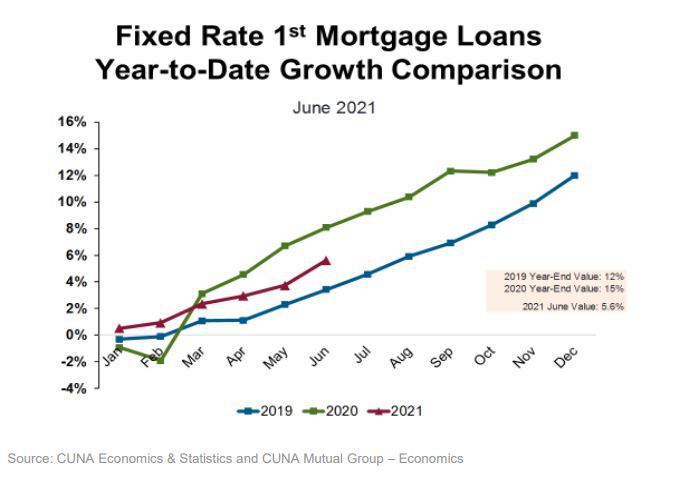

Here’s a look at a comparison of first mortgage loans for credit unions from June of 2019, 2020, and 2021:

Understanding digital mortgage lending

Although there are positive trends for credit unions in mortgage lending, there are many changes taking place in lending and banking in general. Rapid advances in technology and the increased presence of fintech companies in the lending space have made the lending market more competitive.

Let’s look at some of the benefits of digital lending and how credit unions can enhance their digital lending platforms:

- Speed. Speed and convenience are at the forefront of the digital lending phenomenon. These days, people want to be able to apply for a loan on any device and have the decision made almost immediately. The days of lengthy, multiple-channel lending where members came into the credit unions to sign documents are over.

- Security. Because sensitive member data is being shared, it’s important credit unions maintain optimal digital security. The right credit union core technology can assure your digital lending platform is secure, and can also provide features like eSignatures and cybersecurity.

- Seamlessness. Hiring too many third-party vendors for a digital banking platform is a common mistake credit unions make that can lead to a fractured digital experience and inadequate security. It’s important to build a seamless, user-friendly digital mortgage lending platform that members can access from any device. One of the best ways to do this is by choosing the right credit union core technology to support your system.

There are several other crucial elements and features to consider when building your digital lending platform. But it’s clear that using the latest technologies to generate growth through member relationships and mortgage lending will continue to be important.

Key Performance Indicators (KPI’s) and credit union core technology

For credit unions that want to improve their digital lending strategies, analyzing certain key growth metrics or KPIs is vital. Key performance indicators can help you evaluate your CU’s efficiency and identify any areas where your CU could improve. This is vital knowledge for any CU that wants to improve its lending strategies. Two of the most important KPIs for lending are the Loan to Deposit Ratio and Loan Originations Per Employee. Other important KPIs include the Efficiency Ratio, Return on Assets, and the Cost of Technology per Member.

By getting a sense of your key performance indicators and how they stack up against your peers, your credit union can decide if you’re using the right credit union core technology to build your digital banking platform. Choosing the right credit union core technology is critical to running a successful digital mortgage lending platform. At FLEX, we can help you create a seamless mortgage servicing platform that can attract new members and provide them with the digital banking services they want and need. Download our Mortgage Servicing and Digital Lending eGuides to learn more.