Fight or Flight: Credit Union Growth in an Aggressive Environment

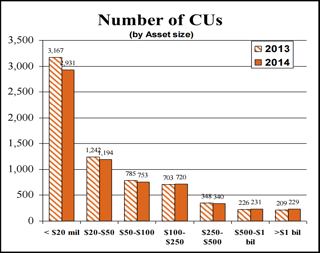

The fight or flight response was first developed by Dr. Walter B. Cannon in 1915. Also called the acute stress response, fight or flight is an automatic reaction to a stressful and potentially dangerous situation. Our brains react quickly to keep us safe by preparing the body for action. Just like animals, humans react to potential danger by either fighting the threat or fleeing from it. In May 2015, CUNA released their credit union trends highlighting changes the credit union industry is experiencing. One of the alarming trends is a drastic decrease in the number of credit unions, especially for those institutions ranging from $20-$100 million in assets. With the loss of 1,316 CU's from this asset range in a years time and competitive pressures remaining, how will your credit union respond... fight? or flight?

The fight or flight response was first developed by Dr. Walter B. Cannon in 1915. Also called the acute stress response, fight or flight is an automatic reaction to a stressful and potentially dangerous situation. Our brains react quickly to keep us safe by preparing the body for action. Just like animals, humans react to potential danger by either fighting the threat or fleeing from it. In May 2015, CUNA released their credit union trends highlighting changes the credit union industry is experiencing. One of the alarming trends is a drastic decrease in the number of credit unions, especially for those institutions ranging from $20-$100 million in assets. With the loss of 1,316 CU's from this asset range in a years time and competitive pressures remaining, how will your credit union respond... fight? or flight?

One credit union with the fight mentality is Loudoun Credit Union of Leesburg, VA. Darrin Myers, CEO of the $40 million credit union, was recently featured on CUInsight with the article "5 Issues Keeping Smaller Credit Unions From Reaching Their Full Potential". The article provides sound and proven advice to help credit unions survive in the competitive financial services industry:

1) Staffing

Or perhaps the lack thereof, staffing of qualified individuals is the key. Finding and retaining staff that is intrigued, engaged and willing to make things better, or do things differently, is the key to limitless credit union growth. Credit Unions in general, need to be pro-active when hiring new staff and we need to look for traits that are not always on paper alone. Here are a few key traits that I’ve looked for when hiring employees:

- Individuals who are not afraid to question all aspects of the business. I love hiring energetic and inquisitive people. The more questions you ask – the more driven and excited I notice that you are.

- Ask your staff for opinions and ideas. I’ve learned that often times the people working the front lines are more knowledgeable than we give them credit for.

- Offer a great work environment. Individuals want to make a living and support their families, but people also want to be happy with the place they spend most of their time. I’ve found that creating an environment that makes “work” interesting, fun and letting people be out-of-the-box thinkers can always bring a positive impact.

2) Assessing your Membership.

Understanding your membership and your core members is the quickest and least expensive way to kick-start your numbers. The people who founded the credit union are the foundation and principle of what you stand for. Tap into those who have a place in their hearts for the credit union and credit union membership growth as well as everything else will take off from there.

- Have your membership work for you; singing your praises and telling your story, because not only is it free, but personal testimonies are invaluable.

- Create and “Live” your Mission Statement. By having a clear and concise brand you will be able to define your business and make it easily understood. Your existing membership can share this with others that may not realize they are looking for a community-based financial system.

- Many credit unions are not close to their actual potential when it comes to membership. Current members are our biggest fans, so why not encourage them to go out and share their stories with friends, family and others? After all, research still shows that “word-of-mouth” is still the best form of marketing.

3) Electing/Maintaining a Committed Board and Supervisory Committee.

When it comes to a not-for-profit financial institution, it is critical to have forward-thinking individuals who want to make our credit unions excel beyond our founder’s dreams. We need board members who look beyond the next 1-2 years and where they want the credit union to be 10-15 years in the future.

- Electing and maintaining an active Board of Directors who is interested and wants to be a part of creating something bigger than us. Finding individuals who use your services are the most important, this gives the Board Member a key to examining what is being done right and wrong in the everyday needs of your credit union.

- Elect a Board of Directors with Different Personalities. We need leaders from all walks of life. Whether you make sure people are safe at stop lights or design plans for a new condominium, you’re knowledge and skill means the world to us. We not only need realists and dreamers, but we need qualified and strong individuals. Not to mention a Chairperson who can bring everyone’s points of interest and ideas to develop a cohesive direction to follow over a 5-10 year plan.

- Be advantageous and use a third party to help develop the direction the board of directors wants to go. They can keep everyone on track at strategic planning sessions and because they are an outside party – they usually put plans in place for the organization.

4) Relaying Your Message to Potential New Members.

Even today we have many potential members who do not understand the purpose or reason for a credit union.

- We need to inform and educate our potential field, whether it is small groups or large auditoriums -we must go out and “meet and greet” where the potential lives and works. These people are our neighbors, our friends, and most importantly, the ones we connect with on a daily basis.

- Marketing internal and external on a budget. Smaller credit unions do not have large budgets to advertise or spend huge dollars on billboards or local TV commercials. Marketing doesn’t have to cost an arm and a leg. Get creative with your marketing dollars – free carwashes in the drive-thru and a pay-it –forward campaign can go a long way with members and lead to credit union growth. Another way to maximize marketing dollars is to tap into the Social Media platform. In most cases it’s free and we can sing our praises and control our message. Email Marketing can take a little extra work, but can be an inexpensive way to meet new and existing members who use us solely as a savings account and to introduce them to the many services we have to offer.

- Be open to any and all ideas. Do not reject any idea because every great invention starts with a crazy thought. Evaluate it to determine if it works within your abilities.

5) Write It on the Wall.

Don’t steer away from the ultimate goal. If it’s growing the credit union in assets, increasing loans or gaining new members, keep a list where you see it every day when you go to work. It doesn’t have to be a tattoo on your forearm, but make it permanent so you are reminded where you want to be in the future.

- Reviewing your Vision and Mission Statements regularly to make sure you are staying on point and going in the right direction.

- Do not get sidetracked from the small details and issues, review, resolve and keep moving forward.

- RRC – Revive, Reinvigorate and be Curious always.

Contributing:

Darrin Myers is currently the Chief Executive Officer for Loudoun Credit Union in Leesburg, Virginia. Darrin has been with the credit union since 2006.

HTTPS://LOUDOUNCU.COM