Building Loyalty Programs for a New Generation of Members

I t's been a topic of discussions at conferences and forums for the past several years - Many credit unions struggle to gain the business of younger members, especially those in the Millennial and Generation Z age groups. New research has found that loyalty programs are a great way to grab their attention. Millennials and Gen Z seek out loyalty programs in almost anything they do. Whether it’s at a coffee shop, wholesale club, restaurant, or their favorite store, these generations want perks. According to a study by Alliance Data, 63% of Gen Z and Millennials agree they have many choices of where to shop, so a brand must show them loyalty to earn their business. Here are several reasons why it's time to focus a greater effort on loyalty programs to nab this market segment:

t's been a topic of discussions at conferences and forums for the past several years - Many credit unions struggle to gain the business of younger members, especially those in the Millennial and Generation Z age groups. New research has found that loyalty programs are a great way to grab their attention. Millennials and Gen Z seek out loyalty programs in almost anything they do. Whether it’s at a coffee shop, wholesale club, restaurant, or their favorite store, these generations want perks. According to a study by Alliance Data, 63% of Gen Z and Millennials agree they have many choices of where to shop, so a brand must show them loyalty to earn their business. Here are several reasons why it's time to focus a greater effort on loyalty programs to nab this market segment:

Think of your members, both existing and those you’d like to gain. While loyalty programs are a great way to grow membership, it’s important to think about the needs of your existing members as well as the target group of potential members. Do some research and find out what your specific field of membership expects from a loyalty program. This way you can meet the needs of your existing members while attracting new members too.

Develop a launch strategy. Even the best loyalty programs can’t attract members if your target audience doesn’t know it exists. The messaging must be personalized to those you want to target and reach them in their preferred delivery medium. For existing members, this may be relevant signage in your branches in addition to a direct mail campaign. However, Gen Z and Millennials will certainly be more accessible through digital platforms like email, social media, and targeted PPC ads.

Provide a seamless experience. A loyalty program that’s well thought out and targeted to the right audience will entice existing members and bring in new ones, however, the user experience is what will make them stay. Loyalty and rewards programs need to be user-friendly, otherwise, members may jump ship. Redeeming and earning rewards should be a simple process and be sure to follow through with what is promised. According to a survey conducted by Bynder and OnBrand, marketers’ top priority in 2018 is customer experience (25%) and loyalty comes in at 17%. This is indicative of members' priorities as well. Although they value loyalty and rewards, the overall member experience is what matters most. Therefore, having a loyalty/rewards program isn’t enough. The resources and experience within that program are equally important.

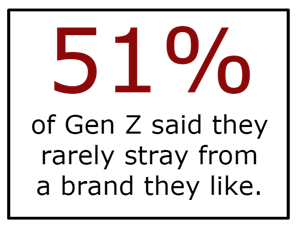

A good rewards program will not only bring in the younger generations your CU is seeking, but it will help retain them as well. 55% of older Millennials said they rarely stray from a brand they like, and 53% of younger Millennials and 51% of Gen Z said the same thing (Alliance Data). Once you get the business of these generations and gain their loyalty, they are extremely reluctant to leave. Competing rates would have to be significantly lower to get them to consider switching, and even then, some would rather stay with their preferred brand. If your CU doesn’t have a loyalty program in place or doesn’t have any offers targeted toward Gen Z and Millennials, it’s time to build one. Their business is out there, and with the right strategy, you could gain a slew of life-long members.

A good rewards program will not only bring in the younger generations your CU is seeking, but it will help retain them as well. 55% of older Millennials said they rarely stray from a brand they like, and 53% of younger Millennials and 51% of Gen Z said the same thing (Alliance Data). Once you get the business of these generations and gain their loyalty, they are extremely reluctant to leave. Competing rates would have to be significantly lower to get them to consider switching, and even then, some would rather stay with their preferred brand. If your CU doesn’t have a loyalty program in place or doesn’t have any offers targeted toward Gen Z and Millennials, it’s time to build one. Their business is out there, and with the right strategy, you could gain a slew of life-long members.