The Impact of Technology on Small Credit Unions

Of course credit union software offers a competitive edge, but it also has no allegiances to scalability or scope. Credit unions of varying size have one thing in common – the means to adopt new, or improve existing technology. A credit union’s outlook on innovation shouldn’t be relative to asset size or membership, but rather on its ability to find a technology solution that works for them and meets their members' needs. Parterning with the right credit union software provider can help.

Of course credit union software offers a competitive edge, but it also has no allegiances to scalability or scope. Credit unions of varying size have one thing in common – the means to adopt new, or improve existing technology. A credit union’s outlook on innovation shouldn’t be relative to asset size or membership, but rather on its ability to find a technology solution that works for them and meets their members' needs. Parterning with the right credit union software provider can help.

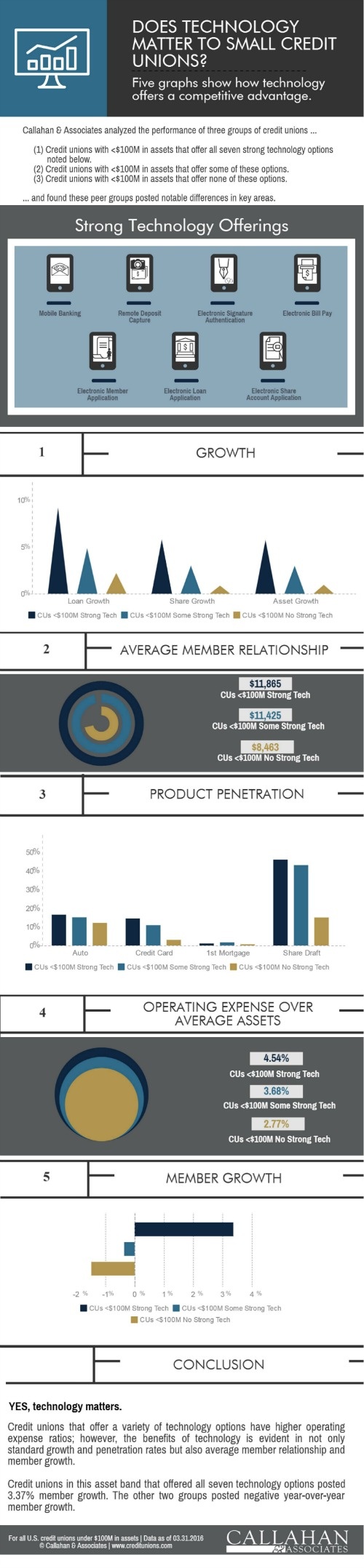

As the infographic below shows, credit union technology can intensify member growth, especially in the 7 areas considered "Strong Technology Options":

- Mobile Banking

- Remote Deposit Capture

- Electronic Signature Authentication

- Electronic Bill Pay

- Electronic Member Application

- Electronic Loan Application

- Electronic Share Account Application

In fact, credit unions that invest in all 7 see, on average, an increase in membership growth by 3.37%. Although operating expenses may rise with an increase in these technologies, there are possibilities of reductions in other costs resulting from increasing economies of scale and reducing the average cost per transaction that the technology brings to the bigger picture. If your credit union core software provider innovates through product development, in place of third-party integration, the cost reductions might be more significant.

Many small credit unions operate on antiquated core technology systems that inhibit, and even prevent new credit union software enhancements. As technology becomes faster, cheaper and more accessible, it should matter to small credit unions more now than ever before. Financial innovation has created new opportunities to transform credit unions. Finding the right fit somewhere along the continuum between being technology leaders and technology laggards will depend on how carefully credit unions choose their technology partner to guide them along the way.