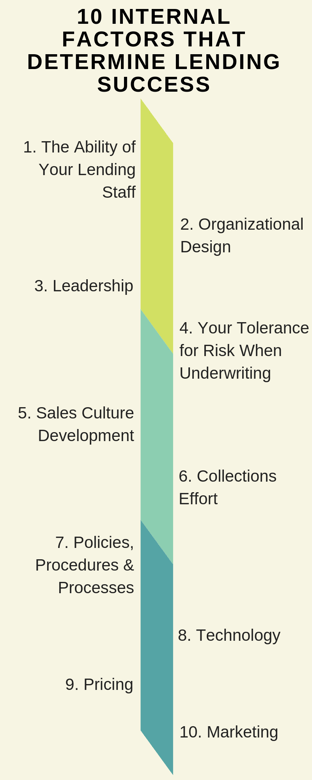

10 Internal Factors that Determine Lending Success

Market conditions are a contributor to the number of loan applications that you receive, but ultimately, your staff and solutions are what make a great lending partnership between members and your credit union. There are several factors within your control that can help your lending process become more efficient, effective, and successful. Here are 10 factors to consider when refining your credit union's lending process.

Market conditions are a contributor to the number of loan applications that you receive, but ultimately, your staff and solutions are what make a great lending partnership between members and your credit union. There are several factors within your control that can help your lending process become more efficient, effective, and successful. Here are 10 factors to consider when refining your credit union's lending process.

- The Ability of your Lending Staff: Your lending staff is only as good as the training you give them. Make sure they are well-prepared to meet with members, analyze their financial situation, and provide the best options to meet their needs. Also, consider using incentives for your lending staff. Working toward a goal will give your staff the drive they need to go the extra mile, and in return, they might get commission or an extra day of vacation time. Not only will this motivate your staff, but it will promote a better manager-employee relationship, and improve the quality of member services as well.

- Organizational Design: Goals and expectations are a key factor to communicate with your staff. Managers need to communicate with their lending team and outline clear expectations. This sets the credit union up for success and eliminates awkward conversations regarding lending performance at the end of the quarter. Staff can’t meet organizational goals if they don’t know they exist, so make sure lending goals are communicated early on, and promote an open dialogue to discuss tactics that will help them reach their best potential.

- Leadership: Credit union management is an essential component of lending success. Not only should managers communicate with members to ensure they’re getting the best possible value and experience, but they should serve as an advisor and mentor to their staff. Monthly check-ins will help lending staff stay on track, and provide the opportunity for feedback to identify areas of their selling process that work well, and those that may need improvement.

- Your Tolerance for Risk When Underwriting: Finding a happy medium with risk will help your credit union reach optimal lending success. While it’s not best practice to accept every single loan application that comes through your door or online, making the underwriting process too selective can be discouraging for members. For borderline applications, take a closer look and see what options are available.

- Sales Culture Development: As mentioned above, setting goals and rewarding loan officers who meet and exceed expectations is a motivator. However, be careful not to make the process overly competitive. The work environment will become clouded with stress if your staff is hyper-focused on reaching sales goals or securing more loans than their co-workers.

- Collections Effort: A repeatable and automated process will make the collections effort as simple as possible. Remaining compliant with collection regulations is made easier when your collections system is designed to be compliant. However, it's still important to internally define collections procedures. An established procedure will provide guidelines to make the collections process organized and repeatable for your staff.

- Policies, Procedures & Processes: Lending should be a smooth process for all involved. The member will become frustrated if they wait too long for a decision, considering most lenders are able to provide extremely quick turnarounds. eSignatures not only reduce the time it takes to make multiple trips to a branch, but they greatly reduce the chance for error. Consistency is also important - members should be held to the same standard, and staff should have an identical process in evaluating applications. This will keep members happy, and operations running seamlessly.

- Technology: Your Loan Origination System (LOS) might be the most imperative piece within your operations, so use it to its fullest potential and offer solutions that members are looking for. Millennials, in particular, seek digital lending, so you’d miss out on a whole demographic of members by not offering it. A multi-channel experience will also allow members to start their application online and finish in your office, or vice-versa, so that's an important option to consider as well.

- Pricing: Stay competitive! Keep an eye on your competitors and see what kind of rates they’re offering. Rates that are far higher than other financial institutions will deter members from your credit union and extremely low rates will not drive the kind of business you want.

- Marketing: Be visible to both members and non-members alike. Newsletters are an easy way to keep in touch with existing members and update them on new products and services your credit union is offering. Social media and other digital efforts will be helpful in reaching potential new members and helping your credit union stay competitive in the marketplace. Members won’t know what you offer until you tell them, so put out content that draws them to your solutions.

Find Digital Lending Success With FLEX

The lending process is fluid. Each applicant is different and may require a customized solution, but your internal lending process it something your credit union can control and perfect over time. By considering the ten factors listed above and using them to guide your lending process, you can provide more successful solutions for your members and staff.