The Second Most Important Investment in Technology... Training

The average credit union spends tens of thousands of dollars or more a year on different aspects of technology, ranging from hardware and software to routine maintenance. But it is also a well know fact that training your staff to use your credit union technology efficiently comes with a price tag.

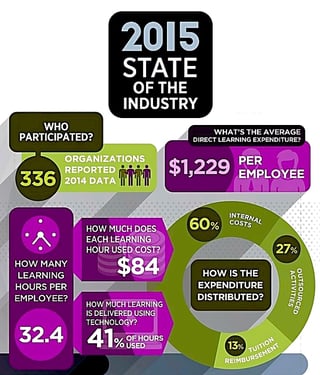

Each year the Association for Talent Development releases a State of the Industry Report highlighting the average amount spent per employee on learning. With 336 organizations surveyed, the average training investment per employee reported in 2015 was $1,229.

It is important to remember that training is the engine that gives your credit union software the horsepower to drive you forward. As your members become increasingly tech savvy, make sure that your staff has the technical training to meet member expectations.

Credit union management may find themselves asking if training is worth the investment. Here are 4 tips to help you measure the ROI of your next credit union training:

- Identify the training investment: What are the objectives of the training and how will your training target these goals. Define the key performance indicators that will show the objectives have been achieved.

- Focus the role of the training solution: What training initiatives will contribute to the overall outcome of employee performance? Don't let your training objectives wander aimlessly. Target your objectives towards quantifiable goals.

- Build a detailed evaluation plan: How can your credit union measure the performance of your employees after the training? In order to accurately determine improvement make sure you have data on your staff's performance prior to the training and review performance periodically following the training.

- Define assumptions and barriers: What other factors might impact the outcome of your performance measurement? For example, take into consideration the amount of time it takes an employee to complete a task may include variables outside of their control, such as member preparedness.

In a fast paced environment where time is limited be sure to set resources aside for credit union system training experiences. In this journey the end isn't knowing more, it's doing more.