Are Large Credit Unions Monopolizing the Industry?

Small credit unions have held their own in the marketplace for years, struggling at times to compete, but with extraordinary resourcefulness, have stayed viable.The latest report from the NCUA, however, provides some alarming data: Large credit unions are getting larger while smaller credit unions are, in fact, getting smaller. It's worth noting that while this is actually a long time industry trend, the strengthening economy has brought with it mounting challenges for smaller credit unions to stay competitive in the upcoming year.

Small credit unions have held their own in the marketplace for years, struggling at times to compete, but with extraordinary resourcefulness, have stayed viable.The latest report from the NCUA, however, provides some alarming data: Large credit unions are getting larger while smaller credit unions are, in fact, getting smaller. It's worth noting that while this is actually a long time industry trend, the strengthening economy has brought with it mounting challenges for smaller credit unions to stay competitive in the upcoming year.

According to the NCUA Q4 Report, federally insured credit unions with over $1 billion in assets saw 13% loan growth and membership was up 9%. Additionally, credit unions with less than $1B but more than $500M, had similar growth; 10% loan growth and 6% growth in membership. While this is good news for them, and the industry as a whole, smaller credit unions seem to be falling behind. CUs with less than $100M in assets saw a drop in membership, as well as a drop in loan growth. Are the larger credit unions proving to be too much competition or are small CUs losing to other competitors?

Not necessarily. As outlined in a recent case study discussing the Connecticut-based Tri-Town Teachers Federal Credit Union, the small credit union survived the financial crisis of 2008 and 2009 to come out ahead years later by investing wisely in technology and using their resources efficiently. This resourcefulness created efficiencies both internally and externally, streamlining processes, and allowing them to operate at times with minimal staff while still having the ability to take on new business and slowly rebuild. Additionally, through their technology partnerships, they were able to offer modern digital banking conveniences that kept current members happy and attracted new ones.

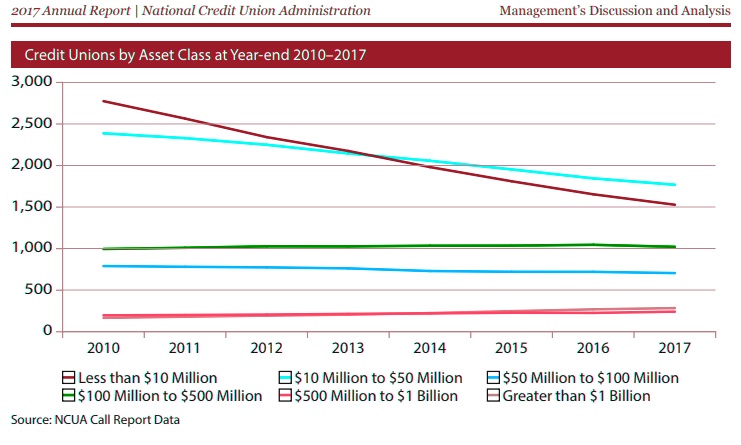

But not all small credit unions have been so lucky. Small credit unions, defined as those with assets under $100M, often find it difficult to compete. Besides the obvious expense of offering digital technology, they also have the pressure to offer the array of comparable products and services that their larger counterparts do. Many small credit unions are choosing to merge as an alternative to competing with larger FIs. Look at the recent NCUA data showing the total number of credit unions broken down by asset category since 2010:

If your credit union is $100 million or less in assets then you find yourself in a rapidly shrinking peer group. However, this shouldn't mean that small credit unions cannot compete in today's market. It simply means they have to be more strategic in doing so.

No matter the size of your CU, defining your credit union's growth strategy, providing competitive member services and the efficient use of technology will keep you relevant with the larger competition in your backyard.