The Qualities Shared By Top Credit Union Core Processor Providers

.jpg?width=300&height=192&name=bigstock-Best-Quality-Assurance-Concept-468614273%20(1).jpg) By taking a close look at the top core providers for credit unions, it becomes clear what many of them have in common. It also helps underline important trends about the industry in general that can be used as inspiration for your credit union's own success in the future.

By taking a close look at the top core providers for credit unions, it becomes clear what many of them have in common. It also helps underline important trends about the industry in general that can be used as inspiration for your credit union's own success in the future.

Credit Union Core Processing: A State of the Union

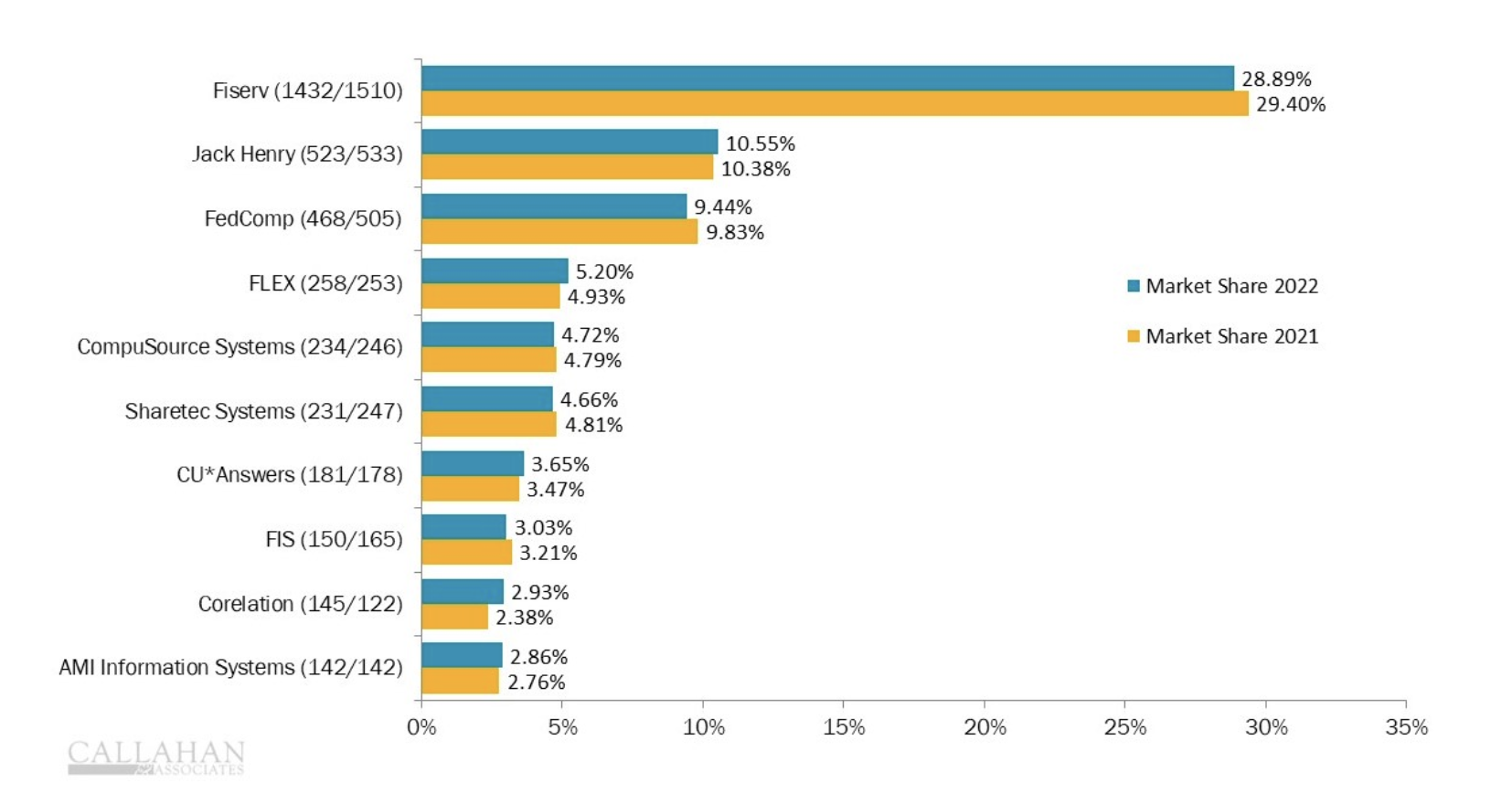

One of the biggest takeaways from recent reporting on the state of credit union core processing providers is that the industry itself continues to grow. At FLEX, we're proud of the fact that we continue to see a great deal of success and growth. According to one recent study, our market share increased in 2022. We enjoyed a 4.93% market share in 2021, compared to a 5.20% share just a year later.

*Image Credit: Callahan & Associates

Based on the strength of the top core processors for U.S. credit unions, one thing is absolutely clear by many of the things they have in common: the technological foundation that they offer to organizations matters more than ever. It's not just about "bringing a credit union" online in the most basic sense. It's about making it possible to offer the types of digital services that members care about--like online and mobile banking. It's about enabling members to walk into literally any branch and receive the same level of service and care that they would expect (not to mention deserve) from that of their primary location.

It's also about offering a credit union core data processing system that helps facilitate an organization's long-term strategy. Growth is a big priority for any credit union (CU) and to get there, your CU needs analytics to help better understand your membership. Your CU needs sophisticated cybersecurity that helps to protect their essential data and make them feel at ease with the services they're utilizing. Your credit union also needs to be able to target members with the products that are most relevant to their needs and embrace automation in a way that improves efficiency across the board.

That is truly a commonality that the top core providers for U.S. credit unions have in common. They tailor their offerings in a way that makes it possible for credit unions to focus on member satisfaction, which in turn goes a long way toward improving member retention. That in turn boosts membership significantly, allowing those credit unions to consistently scale moving forward.

All of this also underlines the importance of going with an organization that has an established foothold in credit union core processor solutions. The big names have achieved that status for a reason--they've seen the industry evolve over time, and they know how to guarantee access to the tools your credit union needs to succeed within your own unique context.

FLEX: Your Partner in Credit Union Core Processing

At FLEX, we've recently authored a document outlining a lot of the benefits these aforementioned qualities bring to the table within the context of a recent credit union core conversion that happened at Industrial Federal Credit Union (Lafayette, Indiana). Click below to read about their successful core conversion--you may discover these upgrades can help your credit union as well!