Lack of Omni-Channel Lending Might Be Frustrating Your Members

Providing an omni-channel experience is key in many industries. For credit unions, the same holds true. Members need the opportunity to engage online, in-branch, by phone and via mobile for a full omni-channel experience. However, when it comes to lending, some methods of communication are more efficient and cost-effective. Encouraging members to apply for loans by phone, online, or through mobile are the best methods for several reasons. Here are 9 ways these channels will be more convenient for staff and the credit union in general:

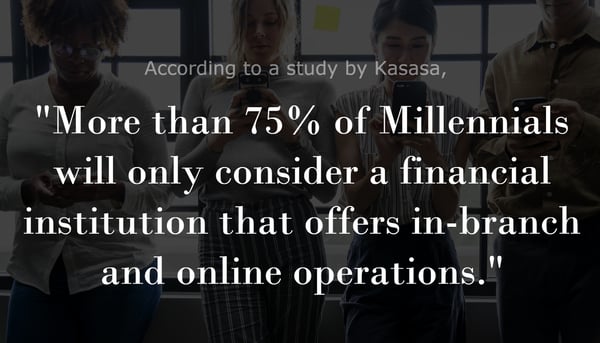

- Over-the-phone, online or mobile applications should work for all members, regardless of their experience with technology. While older members in a credit union might not be comfortable applying for a loan via a mobile device, they should be able to do so over the phone with a staff member walking them through the process. Likewise, Millennials prefer to communicate online or through mobile, so those platforms will cater to them. With a combination of these three platforms, all member should be able to apply for a loan with ease.

- These delivery channels have a much lower per-application cost than orchestrating a loan in a branch. Loans completed in branch take much more time for all involved. Starting an application through phone, mobile, or internet sources will optimize the time spent for all parties, which ultimately makes the loan more profitable for your credit union and creates a better experience for the member.

- Not everyone is great at sales, nor does everyone like sales. Those with charismatic and bubbly personalities tend to flourish in a sales environment, but not every staff member in your credit union is going to be well suited to selling full-time. Applications in these other methods allow staff to skip selling altogether and go straight to the review process. This leaves staff who enjoy and excel in selling to handle the in-branch applications.

- Teaching staff to be successful in sales can be a lengthy process. As mentioned above, not everyone is a natural salesperson. Training staff to be proficient in their selling plan will take more than just a couple of hours, especially if that person is not confident in sales. Providing loan applications in areas other than in-branch will cut back on the number of employees who need sales training, and significantly reduce training costs overall.

- Sales and variable pay go hand-in-hand. If all staff members are selling, each employee will receive some sort of commission, bonus, etc. While variable pay is a great incentive, it can get complicated when payroll comes around. Having fewer employees in sales will reduce complications associated with variable pay.

- Convenience is one of the main reasons why members prefer to use these delivery channels. Driving to the branch can deter members from applying for a loan because finding the time to make a trip to their credit union during business hours can be difficult. With mobile, phone, and online applications members can apply on their own time, which makes the process less stressful and more enjoyable.

- In-branch loan applications can really eat up a huge portion of a staff member’s day. While a good salesperson will take time to get to know the member and learn more about their reasons for applying for a loan, it also prolongs the loan process. On digital platforms, the member might quickly describe these details or select from a pre-defined list, but in-person, it’s likely this conversation will be much more than a couple of minutes.

- Although most applicants aren’t likely to pose a threat to the safety of your credit union, there is some level of risk when inviting a new member into your office. Face-to-face interviews eliminate the barrier that is present with other channels. Should the member become irate with a staff member, it can be harder to diffuse the situation in-person. If the first point of contact is through the phone or online, it reduces the possibility of inviting bad applicants into the office who could potentially threaten your office.

- While the content of the conversation with an applicant is important, in-person interviews require another element of communication: body language. In addition to a personable and pleasant tone, the sales team also needs to perfect body language. A standoffish vibe or a weak handshake could deter a member taking out a loan with your credit union. In other channels, body language isn’t present, so it’s one less thing staff needs to worry about.

Phone, mobile, and online channels are not only more cost-effective, but they are also easier to master. There are a lot of elements at play with in-branch loan applications, and it can be difficult to train the entire staff to be great at selling in-person. While in branch applications are necessary, other channels are much more convenient for staff and members alike. If you aren’t pushing these other loan application platforms to your members, encourage them to apply first and then if needed, finish in branch or clear up any confusion over the phone. Even completing some of the process online or by phone will expedite the application process immensely.